The price of certainty: Key insights into the new economic cycle

The price of certainty: Key insights into the new economic cycle

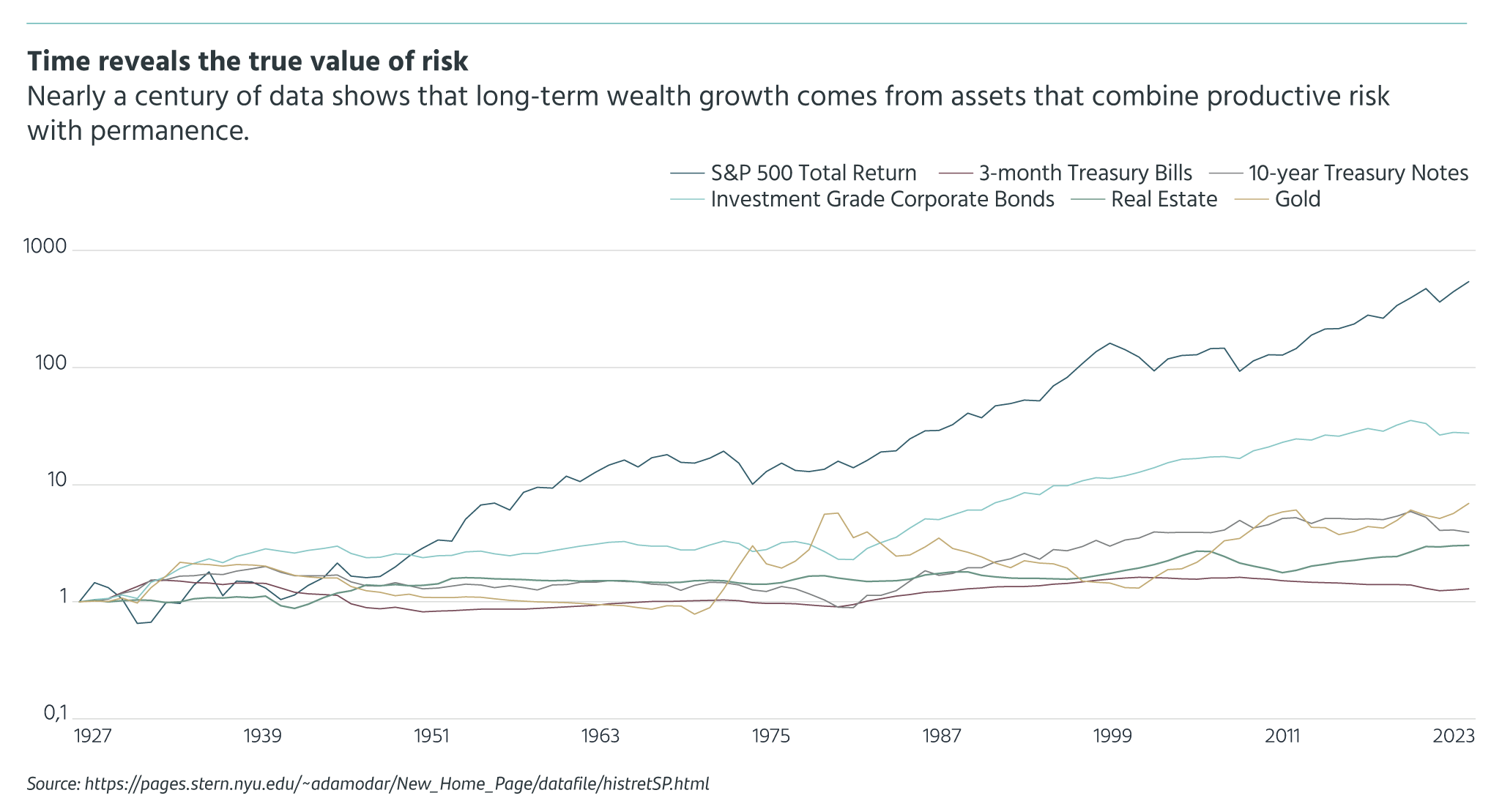

After a decade of abundant liquidity and extraordinary stimulus, the global economy is entering a regime where time once again has a price and risk has meaning. Growth is normalizing, inflation is converging, and positive real rates are consolidating as the foundation of the new financial equilibrium. In this context, the key for wealth investors is not to anticipate the cycle, but to build portfolios capable of living within it.

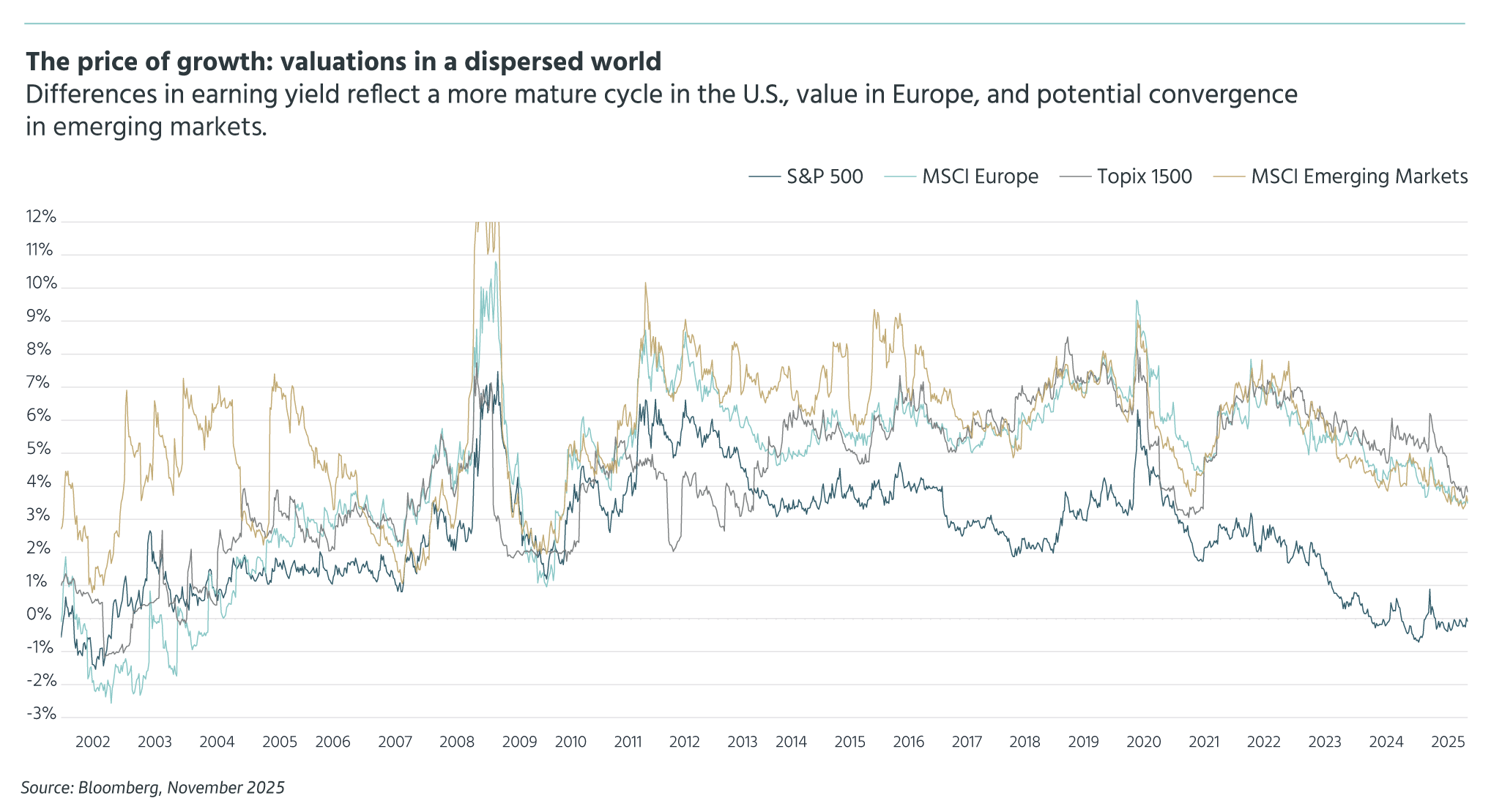

The United States maintains its leadership thanks to innovation and productivity, although with more demanding valuations. Europe offers stability, predictability, and an appealing value proposition, while emerging markets are regaining prominence, supported by monetary discipline and structural dynamism. As central banks reinforce their credibility, returns depend less on liquidity and more on the quality of fundamentals.

The implications for portfolios are clear:

- Equities remain the main engine of growth, but require selectivity.

- Credit and fixed income are regaining their defensive role, with carry as the main source of return.

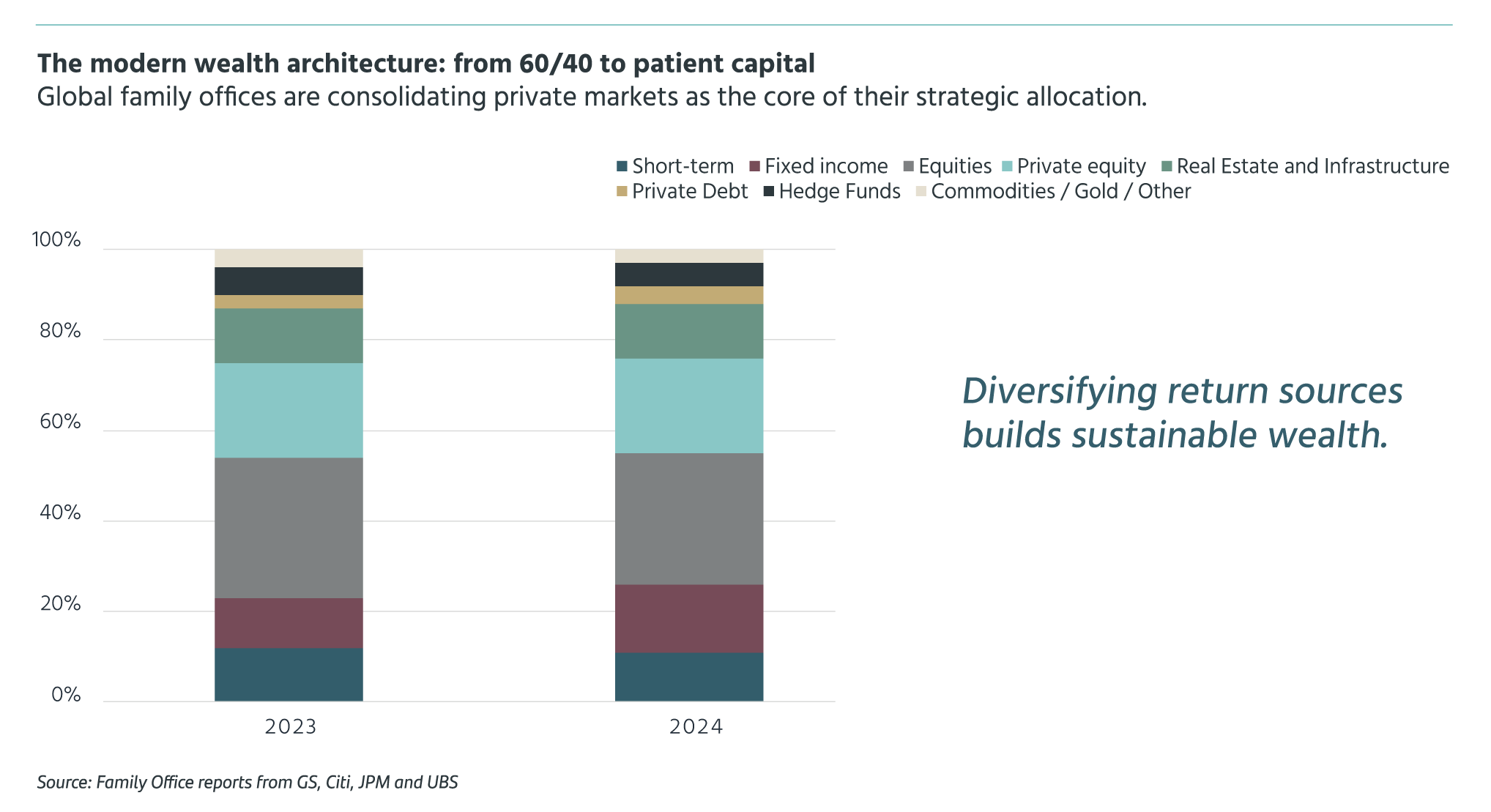

- Private markets — especially secondaries, private credit, and core real estate — are becoming consolidated pillars of intergenerational wealth.

- Gold and real assets strengthen stability in a high-debt environment.

Sustainable returns do not arise from speed, but from consistency: from the balance between growth, income generation, and the preservation of real value.

Important Information

This document has been prepared by Santander Wealth Management & Insurance Division, a global business unit of Banco Santander, S.A. (“WMI”, together with Banco Santander, S.A. and its affiliates, “Santander”). It may include economic forecasts and information obtained from various sources, including third parties considered to be reliable. However, Santander does not guarantee the accuracy, completeness, or timeliness of such information and reserves the right to modify it without prior notice. The opinions expressed herein may differ from those issued by other Santander units.

The content of this document is provided for informational purposes only; it does not constitute investment advice nor does it address specific investment objectives or the suitability criteria of any investor. It does not represent an offer or a solicitation to buy or sell assets, contracts, or products (collectively, the “Financial Assets”), and it should not be used as the sole basis for making investment decisions. Receipt of this document does not give rise to any advisory relationship or obligation on the part of “WMI” or “Santander”.

Part of the content has been prepared with the support of artificial intelligence tools. Santander provides no guarantee with respect to forecasts or the current or future performance of the markets or the Financial Assets. Past performance is not a reliable indicator of future results. In addition, the Financial Assets may not be available for distribution in certain jurisdictions or to certain categories of investors.

Unless expressly stated otherwise in the legal documentation governing a Financial Asset, such assets are not insured or guaranteed by any governmental entity (including the FDIC), do not constitute bank deposits, and involve risks — including market, currency, credit, liquidity, or counterparty risks — that may result in the partial or total loss of the invested capital. Investors are advised to consult their financial, legal, and tax advisors to assess the suitability of each product. Santander and its employees assume no liability for any losses that may arise from the use of this document.

Santander or its employees may hold positions in the referenced Financial Assets or may act as counterparty, agent, or service provider to their issuers.

The information contained in this document is confidential and may not be reproduced or distributed without the prior written consent of WMI. Any third-party material cited is the property of its respective owners and is included in accordance with standard industry practices.

Certain complex or higher-risk products may be offered only to Professional Clients or may be considered unsuitable for Retail Clients.