The 10 Decisions That Matter

The 10 Decisions That Matter

Investing in 2026 requires more than good ideas or access to opportunities. It demands structure, clear rules, and the ability to make sound decisions when conditions become more complex. In an environment of positive real rates, greater dispersion across assets, and more frequent episodes of volatility, the main risk is no longer the market itself, but forced decisions.

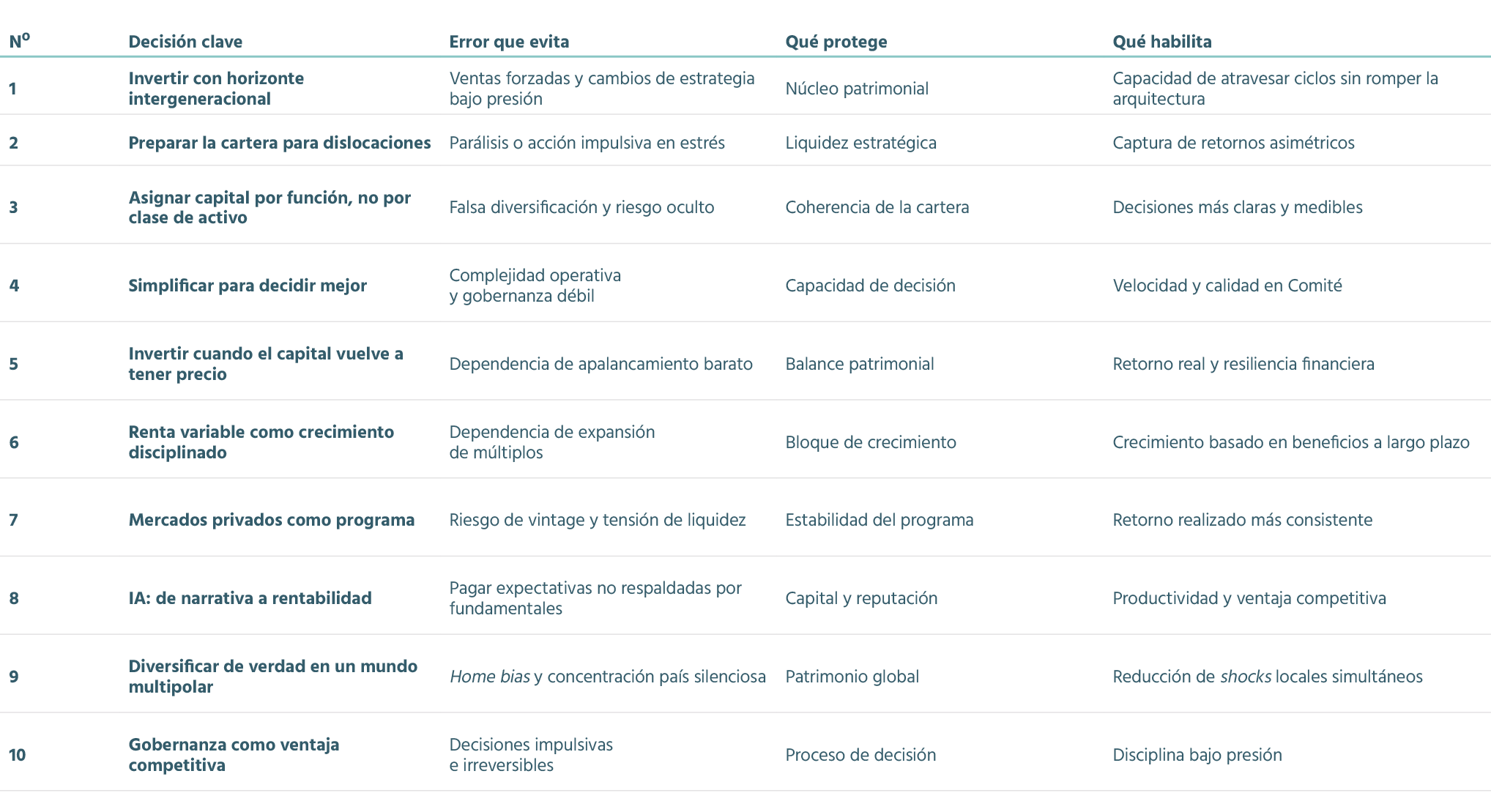

There are ten decisions grounded in a shared conviction: long-term returns depend less on correctly predicting scenarios and more on avoiding structural mistakes, preserving optionality, and maintaining discipline under pressure.

This means, among other things, explicitly separating capital by time horizon, preparing the portfolio for dislocations — not consensus — and allocating capital according to its true function (growth, income, protection, or optionality), rather than traditional labels. It also involves simplifying portfolios to improve decision quality and recognizing that, as capital once again has a cost, cash flow generation, balance sheet strength, and liability management are just as important as asset selection.

In this new regime, equities once again become a central engine of growth — but only when supported by real earnings and shareholder returns. Private markets, meanwhile, must be managed as an ongoing program, with careful oversight of pacing, liquidity, and vintage concentration risk. Artificial Intelligence moves beyond narrative to become a tangible source of monetization and productivity, both in investments and in decision-making itself. And diversification, in a multipolar world, requires going beyond the number of holdings to explicitly address country risk and the family balance sheet’s home bias.

Taken together, these decisions are not about optimizing returns for a single year, but about building a wealth architecture capable of navigating adverse cycles without losing coherence or freedom of action. For large families, the true differentiator in 2026 is governance: simple rules, agreed upon in calm times, that enable sound decisions when certainty disappears.

Important Information

This document has been prepared by Santander Wealth Management & Insurance Division, a global business unit of Banco Santander, S.A. (“WMI”, together with Banco Santander, S.A. and its affiliates, “Santander”). It may include economic forecasts and information obtained from various sources, including third parties considered to be reliable. However, Santander does not guarantee the accuracy, completeness, or timeliness of such information and reserves the right to modify it without prior notice. The opinions expressed herein may differ from those issued by other Santander units.

The content of this document is provided for informational purposes only; it does not constitute investment advice nor does it address specific investment objectives or the suitability criteria of any investor. It does not represent an offer or a solicitation to buy or sell assets, contracts, or products (collectively, the “Financial Assets”), and it should not be used as the sole basis for making investment decisions. Receipt of this document does not give rise to any advisory relationship or obligation on the part of “WMI” or “Santander”.

Part of the content has been prepared with the support of artificial intelligence tools. Santander provides no guarantee with respect to forecasts or the current or future performance of the markets or the Financial Assets. Past performance is not a reliable indicator of future results. In addition, the Financial Assets may not be available for distribution in certain jurisdictions or to certain categories of investors.

Unless expressly stated otherwise in the legal documentation governing a Financial Asset, such assets are not insured or guaranteed by any governmental entity (including the FDIC), do not constitute bank deposits, and involve risks — including market, currency, credit, liquidity, or counterparty risks — that may result in the partial or total loss of the invested capital. Investors are advised to consult their financial, legal, and tax advisors to assess the suitability of each product. Santander and its employees assume no liability for any losses that may arise from the use of this document.

Santander or its employees may hold positions in the referenced Financial Assets or may act as counterparty, agent, or service provider to their issuers.

The information contained in this document is confidential and may not be reproduced or distributed without the prior written consent of WMI. Any third-party material cited is the property of its respective owners and is included in accordance with standard industry practices.

Certain complex or higher-risk products may be offered only to Professional Clients or may be considered unsuitable for Retail Clients.